How To Trade Currency Using Forex Options

Because of this, Forex traders can easily choose the price and date of their preferred option. They will receive a quote regarding the premium they need to pay in .

http://www.onlineforextrading.com/learn-trading/forex-options

Sponsored Links

You can now remove your competitor information from your credit cards numbers Contact Person : Email Address : Contact Number : investment philosophy of warren buffett">Remove Ads About Us

Currency Options – A Simple Strategy for Mega Profits Products & Services

Women:

Men:

Specialty

GAIN Securities | Learn | FX Options | FX Option Prices You might like this

WORLD CURRENCY OPTIONS: TAKE YOUR TRADING TO THE ...

Because options premiums and settlements are in U.S. dollars rather than the underlying foreign currency, PHLX World Currency Options settle in your . http://www.nasdaqtrader.com/content/phlxwco/wcobrochure.pdf FX Options Foreign Exchange: A Practical Guide to the FX Markets - Tim ... 1.

Getting Started In Forex Options Tel 6835 7846

2.

Stochastic risk premiums, stochastic skewness in currency options ... Tel 6835 7846

3.

Reference Manual - Currency Options Tel 6734 1516

4.

Option Contracts Tel 6836 6610

5.

Giddy: Myths About Foreign Exchange Options Tel 6509 9286

Forex Options Tradings| Easy-Forex

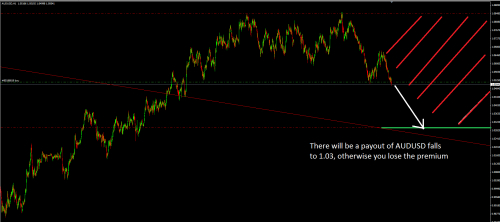

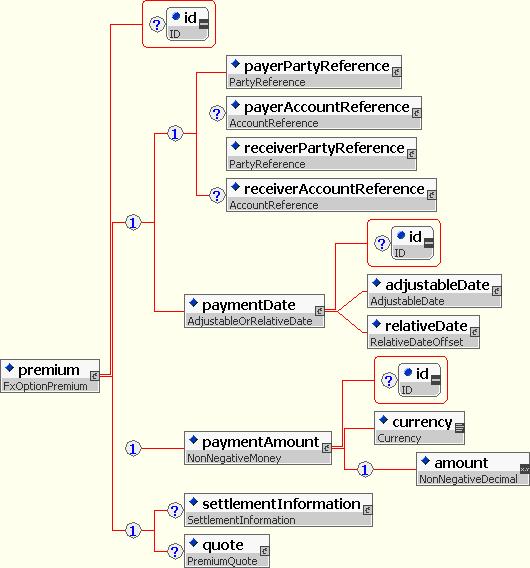

What is a premium? A premium in the Forex market makes the option deal possible. The premium is the price the trader pays to the broker to establish the option . http://en.easy-forex.com/int/options.aspx

|

Darryl

Darryl

HP

HP