Knock-In Options | Definition and Example | Oz Forex Foreign ...

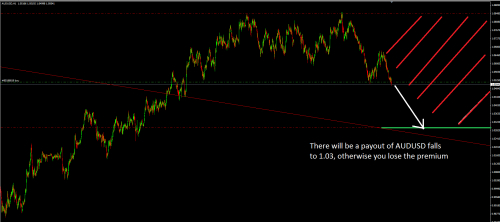

A knock-in option is an option that only comes into being when a pre-specified spot level is reached. Once the option comes into existence it has all the .

http://www.ozforex.com.au/guides/currency-options/types/knock-ins

Sponsored Links

You can now remove your competitor information from your car vinyl flat black Contact Person : Email Address : Contact Number : health xpress loan">Remove Ads About Us

Forex Hedging - Introduction to Forex Hedging Products & Services

Women:

Men:

Specialty

GAIN Securities | Learn | FX Options | Trading FX Options You might like this

30 Foreign Currencies | Foreign-Exchange Options

Currency options on futures are options on a currency future contract on a US . example, with an assumed forward rate of USD / CHF 1.30 and a call option . https://www.credit-suisse.com/ch/unternehmen/kmugrossunternehmen/doc/devisenoption_en.pdf Forex Binary Example | USD JPY B. Nikolic: A simple FX-Option Example in QuantLib 1.

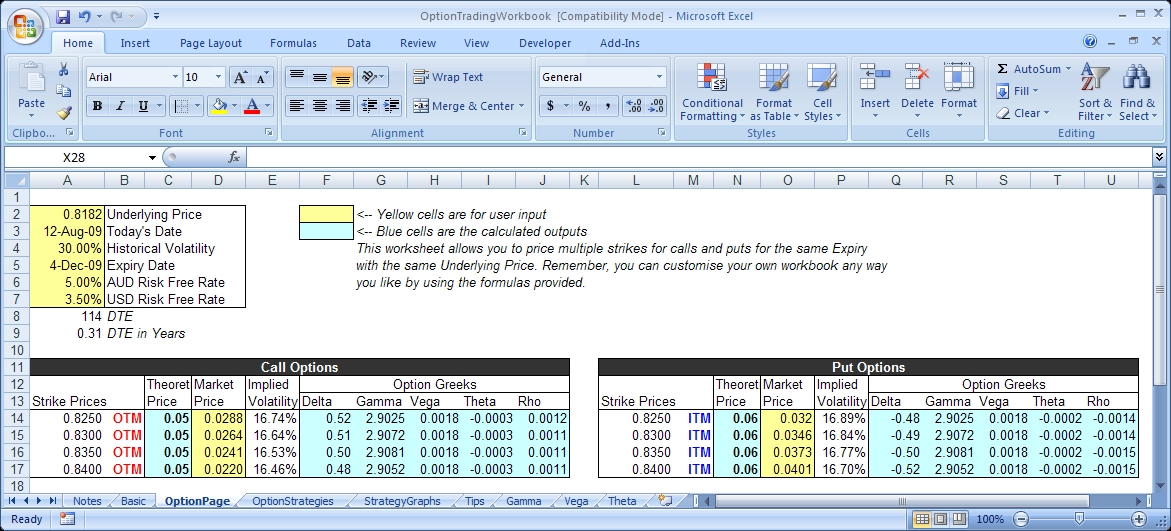

Currency Option Pricing Tel 6835 7846

2.

Oz Forex | Average Rate Options | Definition and Examples Tel 6835 7846

3.

The Pricing of Call and Put Options on Foreign Exchange Tel 6734 1516

4.

Currency Option Combinations Tel 6836 6610

5.

Currency Option Definition | Investopedia Tel 6509 9286

Average Rate Option (ARO) Definition | Investopedia

Average rate options are typically purchased for daily, weekly or monthly time . that receive payments over time that are denominated in a foreign currency. . For example, a U.S. manufacturer agrees to import materials from a Chinese . http://www.investopedia.com/terms/a/average-rate-option.asp

|

Darryl

Darryl

HP

HP